Introduction – An Overview of Company Incorporation

Incorporating a company may appear daunting and troublesome, with heavier administrative and compliance tasks to take care of. Nevertheless, incorporation can be very essential as you grow your business for a number of reasons, including the protection of your personal liability, the separation of the business entity from the owners and the investors, the ease of ownership transfer, the raise of external funds, and potentially the creation of tax benefits. This guide navigates you through the key issues that you need to consider and go through before and during the process of incorporation.

Definition

Incorporation is the legal process used to form a corporate entity or company. A corporation is a legal entity that separates the firm’s assets and income from its owners and investors.

Advantages of Incorporating your Business

- Protects the owner’s assets against the company’s liabilities

- Possible tax advantage

- Usually receives more lenient tax restrictions on loss carry-forwards

- Allows for easy transfer of ownership to another party

- Can raise capital through the sale of stock

Step 1: Select a Company Name and Type

Types of Companies

- Company limited by shares “Limited by shares” means that the liability of the shareholders to creditors of the company is limited to the capital originally invested, i.e. the nominal value of the shares and any premium paid in return for the issue of the shares by the company. A shareholder’s personal assets are thus protected in the event of the company’s insolvency, but any money invested in the company may be lost. This is one of the most common forms of companies.

- Company limited by guarantee A company limited by guarantee (CLG) is a type of corporation incorporated primarily for non-profit organisations that require legal personality. A company limited by guarantee does not usually have a share capital or shareholders but instead has members who act as guarantors of the company’s liabilities, where each member undertakes to contribute an amount specified in the articles in the event of insolvency. Non-profit-making organisations usually choose to register as companies limited by guarantee.

Company Names

After deciding on which type of company you would like to form, it is time to name your company.

Please pay attention to the following naming rules:

- A company name may be in English or Chinese, but a combination of both is disallowed. A company may have a Chinese name and an English name.

- Names identical to the existing ones are disallowed. You can go to the cyber search centre or the company search mobile service to check your choice.

- Names that infringe trademarks or intellectual properties are disallowed.

- Names containing specific expressions (like “Trust”, etc.), or too similar to existing ones may need prior approval from the Registry.

- The complete official naming guide is available here.

Step 2: Prepare Required Documents and Registration Fee

Incorporation Form

An incorporation form is required on registration. The form collects all the information of the incorporation, including the name, initial shareholdings, founder members’ particulars, etc.

- Download the form here.

Articles of Association

The Articles of Association (AOA) is a company’s document that forms a company’s constitution and defines the responsibilities of the directors, the kind of business to be undertaken, and the means by which the shareholders exert control over the board of directors. Together with the Memorandum of Association (MOA), AOA is the constitution of the company.

- Official samples are available here.

A Notice to Business Registration Office

The notice is intended to notify the Business Registration Office of your choice on the expiry date of any business registration certificates issued.

- The notice is downloadable here.

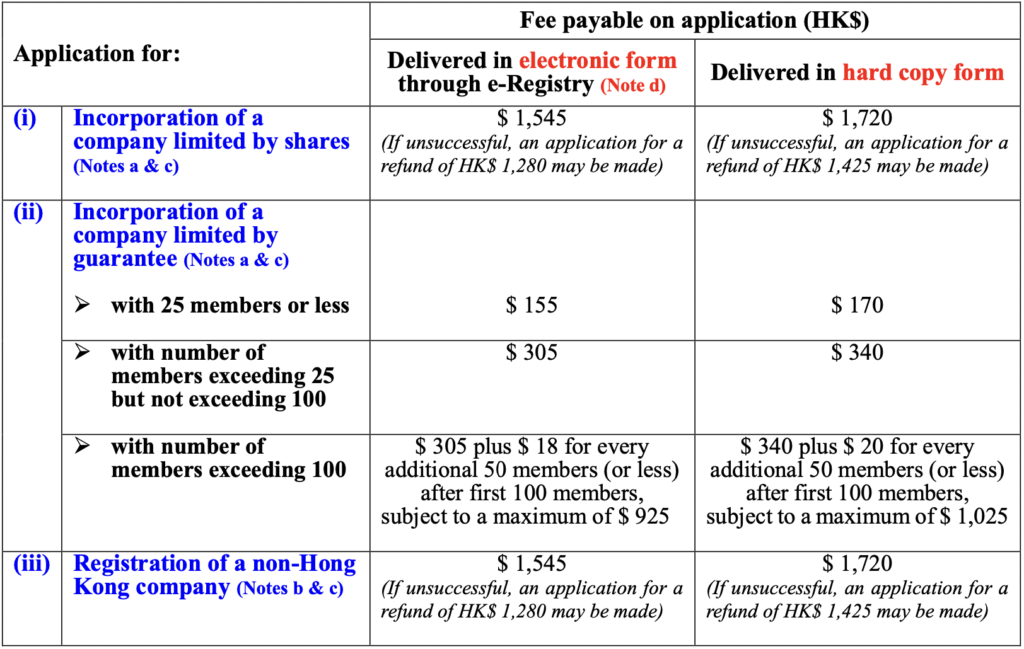

Registration Fee

- For more details, you can check out the official document here.

Step 3: Submit your documents

- Method 1: Submit your application online via E-Registry

- Method 2: Submit your application in person at the Shroff on the 14th Floor of Queensway Government Offices.

Step 4: Collect your certificates

💡 Depending on the mode of your delivery of the application, certificates will be issued either in soft copy or in hard copy. Both forms have the same legal effect.

Application via electronic form

For private companies limited by share, the electronic certificates will normally be issued, if authorised, within 1 hour after your application. Please check the registered mailbox to view and download the certificate.

Application via hard copy

For companies limited by share, the hard copy certificates will normally be ready to pick up in 4 working days. Once ready, you will be notified by fax. Remember to take the Notification of Collection of Certificate(s) and identification documents or the company chop to collect the certificates at the Registry.

If the collection is to be done by a representative, written authorisation and the identification document mentioned therein are required.

Additional Step: Obtain other permits or licenses

💡 Business Registration Ordinance (Cap.310) A business registration application shall be made within 1 month of its coming into operation.

- Please visit this website to start the application for the license.

- If your business involves imports and exports, please further explore this website.

Post-registration Essentials – Read These Guides!

- Open up your company’s business bank account. See more here at Opening Bank Accounts in Hong Kong

- Know your compliance obligations. See more here Guide to Annual Filing Requirements in Hong Kong

Additional Readings:

- [Official] Companies Registry – How to register a new company?

- [Official] Companies Registry – Guideline on Registration of Company Names for Hong Kong Companies

- Hong Kong Company Registration Guide and Hong Kong Corporation for First Time Entrepreneurs by GuideMeHongKong