ESG is all the rage. In response to increasing investor appetite for ESG products or companies with high ESG ratings, more professional training and higher education institutions are now offering trainings and certifications focusing on ESG compliance, planning, and investing. Understandably so, because ESG consultants are in high demand, as companies compete for the small pool of talents equipped with ESG acumen to help them achieve corporate sustainability goals.

The current status of ESG investing is not without flaws and criticism, however. For example, most leading ESG ratings firms don’t compute their ratings in relation to a company’s sustainability practices; rather, they measure how environmental, social, and governance factors can affect a company’s bottom line. This can perhaps explain why one of the world’s largest tobacco companies is listed on the Dow Jones Sustainability Index: even though it sells addictive and harmful products, ESG ratings firms may give the company a high rating as they think the regulatory risks are being controlled and mitigated.

Moreover, the lack of standardization in the ESG metrics and data used in self-reporting and third-party audits means it is difficult to validate or compare performances, leading many to question the value of ESG compliance and ratings.

The good news is that efforts are underway to standardize ESG metrics and reporting, including the one by the International Sustainability Standards Board to create one single approach to ESG disclosure.

What is ESG? Why is it Important for Startups?

Indisputable is the potential of ESG investing and its financing power to help companies with a track record of sustainability practices grow. But when even investors interested in impact investing are confused about ESG, how can entrepreneurs and companies know what to comply with in order to reap the financial benefits?

“Everyone is talking about ESG these days, and we want to find out what that means to the companies of our mentees and mentors,” said Vivian Seo, Program Manager at Foundation for Shared Impact.

That is why, on 29 November, we collaborated with Gerard Escaler, Chief Marketing Officer at Lyrium Venture Partners, to hold the Demystifying ESG workshop for the entrepreneurs of our Mentorship Program for Ethnically Diverse Entrepreneurs.

“ESG is important for startups and early-stage companies,” said Gerard, who has helped several multinational firms and startups with their sustainability initiatives. “By 2030, Millennials and Gen Z will comprise the majority of the workforce, and they prefer to work at companies with a strong CSR policy and commitment to social and environmental change, some are even willing to take a pay cut to do so. Not only that, they also prefer brands that go beyond greenwashing and integrate sustainability in their business operations. What this means for companies is that if you want to attract young talents and customers, you should begin to integrate ESG in your strategy.”

In fact, this is exactly what many companies are doing. According to the findings of a survey by KfW Capital and Boston Consulting Group of 76 venture capital funds and 109 startups, the main drivers for respondents to consider ESG were to attract new customers and higher sales expectations.

There are strategic advantages of ESG integration, said Gerard, including sustainable competitive advantages that are difficult for your competitors to duplicate or exceed, increase in investment, and enhanced risk mitigation. “Additionally, integrating ESG in your business can generate positive PR, raise brand awareness, and increase stakeholders’ trust in your brand. And, as mentioned earlier, it gives your company the competitive advantage to hire and retain talents.”

Integrating ESG in your startup now is also a proactive approach to compliance. While most legislation currently focus on larger organizations, startups and small- and medium-sized enterprises will likely be required to comply with such legislation soon. As you will learn below, integrating ESG in your business strategy is a process that requires careful consideration and extensive coordination. Starting the process early can give you a headstart over your competitors.

To be clear, although ESG, Corporate Social Responsibility (CSR), and sustainability are often used in the same context, they are three different frameworks used for different purposes. The chart below offers an overview of each of them.

Overview of ESG Risks

To give our entrepreneurs an overview of ESG risks, Gerard elaborated on some environmental, social, and governance factors that may affect a company’s operations and bottom line. Utilizing MentiMeter, Gerard also asked the entrepreneurs to name several ESG risks to their businesses.

“Key environmental considerations such as climate change, carbon emissions, water stress, pollution and waste are risks that can adversely affect a company,” said Gerard. Contrarily, opportunities in renewable energy, green building, and clean tech can be beneficial to a company specializing in sustainability services and products.

An environmentally-responsible company, in other words, would work towards cutting its Scope 1, 2, and 3 carbon emissions and, at the very least, ensure its operations do not cause further damage to the environment.

The S in ESG typically refers to a company’s ability to fulfill commitments to support the community and social equity programs for its internal and external stakeholders, including its employees, customers, vendors and suppliers, and the community.

Here, the key social considerations include human capital development, employee access to healthcare, supply chain labor standards, product safety and quality, data privacy and security etc. A socially-responsible company would treat its employees and customers fairly and equally. It would also conduct due diligence on potential suppliers to ensure they abide by ethical principles before working with them.

The G in ESG is related to an organization’s ethical and legal management, the transparency and accuracy of company performance, and involvement in other ESG initiatives. While the company’s board and senior management usually set the tone and policies that guide decision-making, its governance risk model can also be influenced by employees, investors, customers etc.

Some key governance factors include board diversity, business ethics, accounting, executive pay, corruption and instability. For example, any company committed to risk mitigation and oversight would establish a board of directors that bring a diversity of experiences and perspectives.

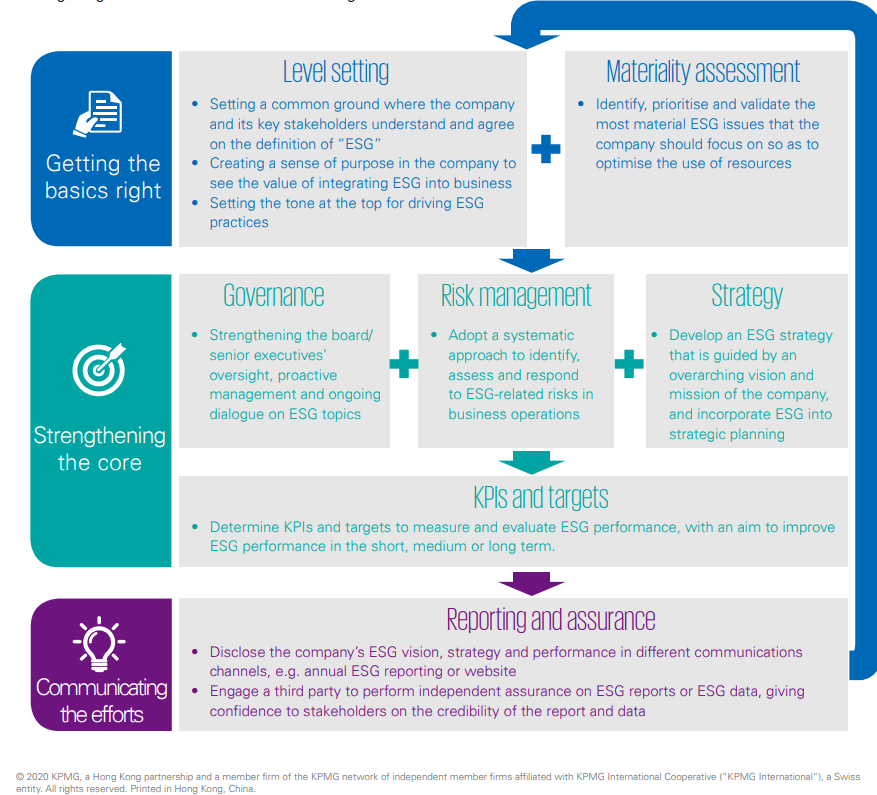

Source: KPMG

ESG Strategy and Integration

There are three phases to integrating ESG in your business. Phase One focuses on getting the basics right through level setting and conducting a materiality assessment. Phase Two works on strengthening the core, developing a strategy, and setting KPIs. Phase Three is about communicating your ESG efforts through reporting and assurance.

Phase One: Level Setting and Materiality Assessment

Phase One involves establishing a foundation for your company’s ESG strategy. This is done by setting a common ground where your company and key stakeholders understand and agree on the definition of ESG. Doing so can help get more buy-in for your company’s ESG development.

Here, it is important for the board and leaders of your company to gain a clear understanding of the value and relevance of ESG to your business. The board and leaders can then set the tone and create a culture that encourages employees and other key stakeholders to align with your company’s ESG priorities.

Source: KPMG

Materiality assessment, essentially, is the process of identifying, prioritizing, and validating the ESG areas that matter most to your company and your stakeholders. With the help of a materiality matrix, you can map out the ESG issues that are most important to your internal and external stakeholders. Let the insights guide your ESG strategy and communications efforts to tell a more compelling story of sustainability.

There are seven steps to conducting a materiality assessment:

- Identify key stakeholders: Create a list of stakeholder groups and then identify key contacts who can provide insight into your sustainability strategy e.g., beneficiaries, partners, donors, members of local community, employees.

- Pitch stakeholders to get them on board: Get in touch with stakeholders early on to set the stage and let them know you want their participation.

- Identify ESG issues and metrics: Determine what sustainability issues and metrics to measure to obtain the insights you desire. Aim for both quantitative and qualitative insights.

- Design survey: Design your survey to ask stakeholders to rate the importance and impact of each indicator you’ve identified on a numerical scale.

- Launch survey: Reach back out to your stakeholders and provide them with the link to the survey and a deadline.

- Analyze insights: Review results collectively and individually to determine what issues are most important to each stakeholder group.

- Put insights into action: Share your results and continue to engage stakeholders in dialogue.

Phase Two: Execution

ESG integration and reporting requires sound governance at the company. It is important to ensure board members and senior management have relevant ESG expertise and experience. At the same time, strengthen the board’s and senior management’s accountability, oversight, proactive management, and ongoing dialogue on ESG topics.

Equally important is for the Risk Management committee to adopt a systematic approach to identify, assess, and respond to ESG-related risks in business operations.

When integrating ESG in your business, the key to success is developing an ESG strategy aligned with your company’s vision and mission. This way, achieving ESG goals can also contribute to business growth. Here, be sure to determine KPIs, targets, and how you’re going to measure success. It is crucial to collect and track the right data to effectively measure, monitor, and assess your company’s ESG performance.

Phase Three: Communication

In Hong Kong, all listed companies are required by the Hong Kong Exchanges and Clearing Limited (HKEX) to disclose their ESG performance and publish their ESG report annually since 2016. Amongst the new requirements added to its ESG Reporting Guide is the HKEX’s recommendation to listed companies to engage a third party to perform independent assurance on ESG reports, to add credibility to the data disclosed in the reports.

However, seeing the various advantages good ESG performance can bring, many companies are going beyond regulatory compliance to communicate their ESG vision, strategy, and performance to their stakeholders and broader community. Some of the internationally recognized reporting standards and frameworks used for this purpose include the Global Reporting Initiative (GRI) Standards, the United Nations Sustainable Development Goals (UN SDGs), and the Sustainability Accounting Standards Board (SASB).

ESG and Customer Experience

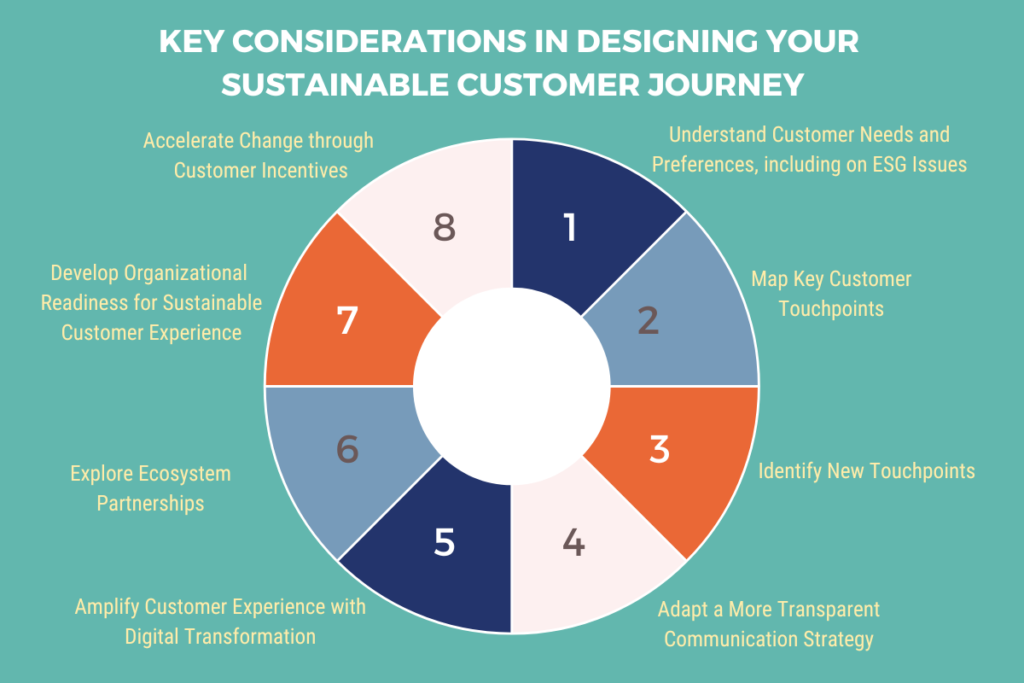

For entrepreneurs who are ready to integrate ESG in their business, Gerard recommended some key considerations in designing a sustainable customer journey.

- Understand customer needs and preferences, including on ESG issues.

- Map key customer touchpoints.

- Identify new touchpoints in order to steer customers towards more sustainable products.

- Adapt a more transparent communications strategy by utilizing data and presenting it in an easily understandable way.

- Amplify customer experience by leveraging digital transformation: analyze customer behavior, improve customer experience, protect customer privacy, making data accessible by making use of public and private data clouds.

- Explore ecosystem partnerships: look into your value chain to identify partnership opportunities.

- Develop organizational readiness for sustainable customer experience: training key stakeholders to communicate how sustainability aligns with your value proposition.

- Accelerate change through customer incentives: educate customers to change behavior and steer them towards more sustainable options.

Actionable Next Steps

After guiding the entrepreneurs through the first three steps of materiality assessment, Gerard tasked them with the remaining four steps after the workshop. He also offered some other actionable next steps.

“If you haven’t yet, start identifying the relevant ESG factors for your company or your industry,” said Gerard. “Once you have done that, develop an ESG measurement and reporting strategy. Think about what your objectives are, and what you want to achieve with ESG and sustainability.”

In addition to considering a third-party certification like B Corp, entrepreneurs can also use the GRI Standards to start integrating ESG into reporting and governance documents. “And if you want to learn more about how ESG fits into your customer journey, you can always email me!” said Gerard.