The Steps to Growing Your Startup

This guide aims to introduce you to the different stages of a startup’s journey, from its early formation to its venture-funded growth and finally, its late stages or exit phase.

Is my business a startup?

A startup is one of the many types of entrepreneurial ventures in the world, but what is it exactly?

A startup is conventionally defined as a high-growth and highly-scalable venture intended to grow large beyond its founding team into a profitable corporation. In the long term, they possess expansive dreams to not only compete but disrupt large and established companies. A startup’s most defining characteristic is speed and growth. For this reason, startups often have high starting costs and demand funding from external sources in order to support their fast-paced research, development and operations.

Is your startup’s primary objective to create social impact?

If your business is primarily intent on achieving social goals, with financial objectives coming at a close second, then it is more accurately referred to as a social enterprise. Social enterprises are private commercial entities that reinvest their profits into social programs instead of paying out dividends to external investors. To understand how you can secure external funding for your social enterprise in Hong Kong, click the link below!

A Social Entrepreneur’s Guide to Funding in Hong Kong

Identify your startup’s funding stage

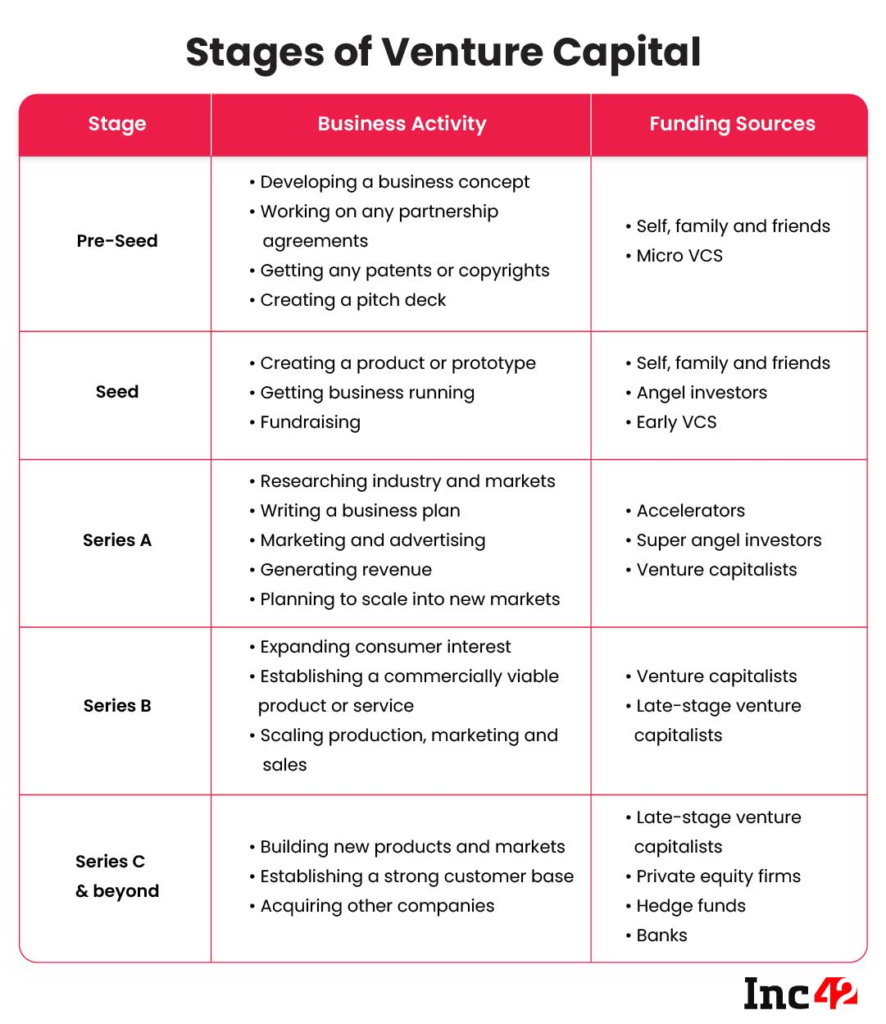

The table below briefly demonstrates each stage of VC funding. In terms of funding and development, which stage is your startup currently at?

Venture Capital Funding

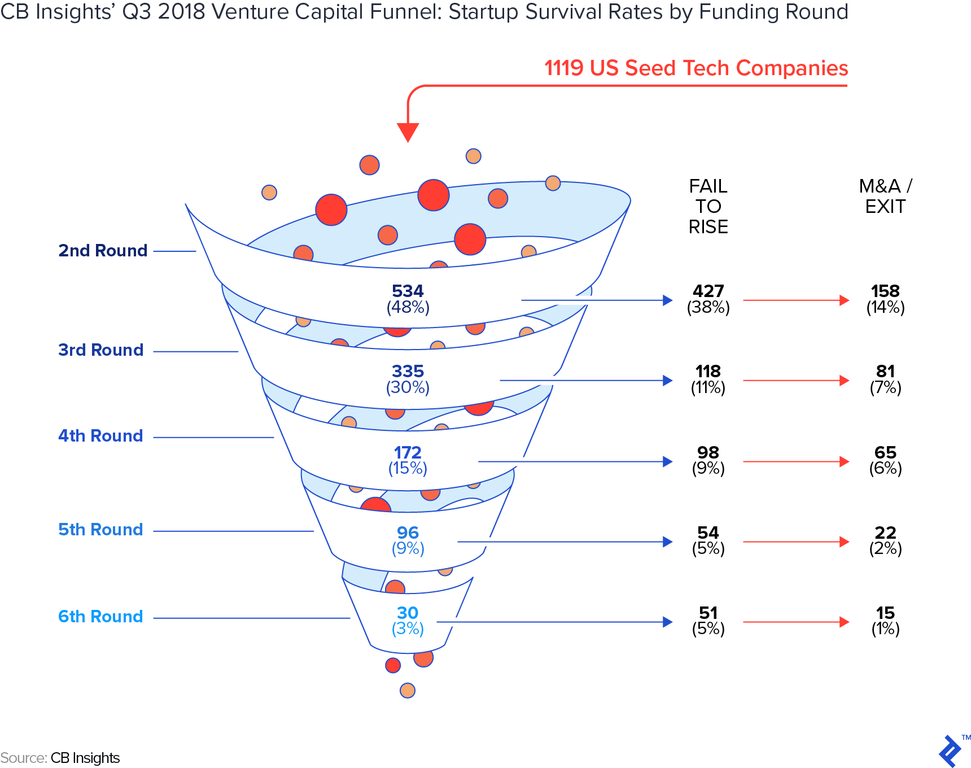

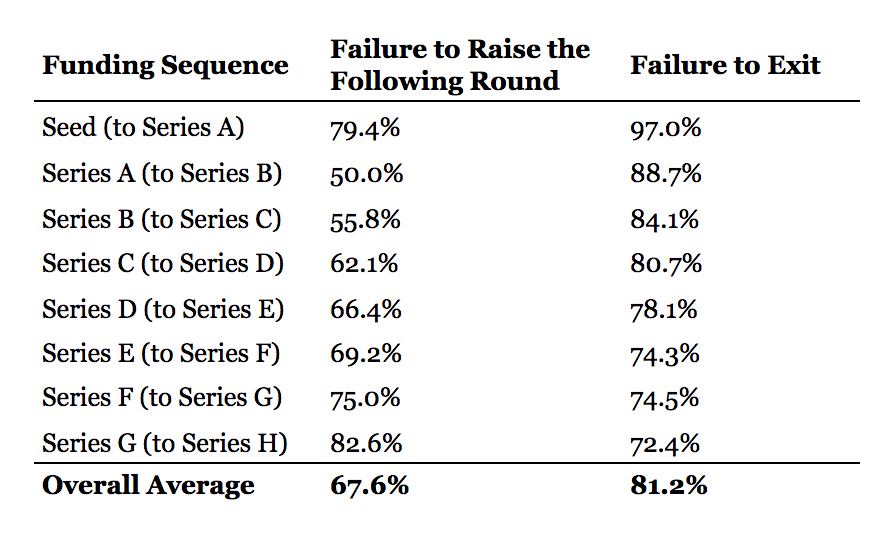

One of the most suitable and common types of external funding for post-seed startups is through venture capital (VC) investments. VC firms raise money from limited partners and use it to invest in promising startups in exchange for a minority stake in its portfolio company. A startup’s ‘survival’ can be measured by its success in raising the next sequential round of capital, or its success in exiting the VC funnel, for example, via an IPO (Initial Public Offering) or acquisition.

As you can see from the diagram above, a startup’s survival rate at increasing funding rounds tends to follow a declining funnel-like distribution. But there is a silver lining: The further along you are, the more mature your company is and the more likely you are to succeed.

Early & Growth Funding Stages

The first three phases of capital-raising in startups are mainly the pre-seed, seed, and Series A funding stages. Fundraising in the early stages is usually necessary to drive the growth of the startup, validate a business plan and optimize the product, instead of being funneled into scaling and commercial expansion.

Pre-seed Funding

Potential investors you can explore:

- Founders’ personal funds

- 3Fs (Friends, Family, Fools)

- Early-stage angel investors

- Non-institutional, Industry-specific private investors

- Accelerator programs

- Others: Small business loans, Crowdfunding

Typical amount raised: US$50,000-250,000

Seed funding

Potential investors you can explore:

- Angel investors

- Early-stage VCs

- Incubators & startup accelerators: https://hkstartupsociety.hktdc.com/en/resources/funding-and-incubation-schemes

Typical amount raised: <US$5 million

(P.S. Conservative is good. Just because you can raise a certain amount of money at the seed round, doesn’t always mean that you should!)

Series A funding

Potential Investors:

- Venture capitals

- Equity crowdfunding

Typical amount raised: US$2-15 million

Later Funding Stages

Once you As Twitter co-founder Biz Stone once said, “Timing, perseverance, and 10 years of trying will eventually make you look like an overnight success.”

Series A is only the beginning of the venture capital equity funding process, followed by Series B, Series C, and so on. What can you expect from these subsequent rounds of funding?

Series B funding

This next funding stage may see around US$7-10 million being raised from venture capital firms, often by the same investors who led the previous round. A significant amount of this money will be dedicated to expanding your startup’s team and target customer base.

Series C funding

Securing this stage of investments not only indicates that your company is ready to develop new products and expand into wider (or international) markets, but also represents the final push to prepare for an IPO or acquisition. Valuation at this stage is not founded on financial projections, but on hard data points such as your current revenue and existing number of customers. This funding stage may not only come from venture capital firms but also private equity firms, banks, and hedge funds.

Series D funding

While Series C is often the last round raised by a startup, a few may choose to raise an additional Series D round if they desire to remain private for longer or to further increase their valuation before going public.

Now, Are You Ready to Begin Preparing for Fundraising?

This guide is the first of our 3-part startup fundraising series, followed by “A Startup Founder’s Checklist for Early-Stage Fundraising” and “Guide to Startup Funding Options in Hong Kong”.