Why do I need a bank account?

When you start a business, opening a bank account should be one of the first housekeeping tasks for you to manage all transactions for your business purpose, from receiving payments from your customers, paying salary and business expenses, tax, etc. Read this guide to learn all you need to know about opening up your bank account in Hong Kong.

Choose Your Bank and Plan

💡 Different banks offer different corporate banking plans. Choose the bank and plan that best fits your business. Note that in Appendix I of this guide, we’ve listed some major banks in Hong Kong where you may open your first account.

You may refer to the website of the Hong Kong Monetary Authorities for more information on banking information, including contacts, and account specifics. Find here the link to Hong Kong Monetary Authority – Contact Details of Banks.

We recommend you research and compare the amount of minimum deposit required by each bank, as well as any one-off account opening fee and/or monthly fee to maintain the account before you make a decision. The initial deposit amount may vary from HKD 5,000 to HKD 50,000, and the processing fee to open a bank account may also vary quite broadly from HKD 500 to HKD 10,000. Read this guide by Startup Registry where the relevant fees are compared.

Prepare The Documents

💡 After choosing the banks and plans, you may proceed to prepare relevant documents for the account opening. Depending on the nature of a company, banks require different documents. Here we have listed the common documents that are normally required, for your handy reference. PLEASE DO REFER TO THE OFFICIAL WEBSITE FOR YOUR CORRESPONDING BANK FOR MORE DETAILS.

Click to read the documents required for Corporate Customers

- Corporate identification documents, for example:

- Certificate of incorporation

- Report from a company registry

- Certificate of Incumbency;

- Certificate of good standing;

- Record of registration;

- Partnership agreement of deed; or

- Constitutional document

- Information of the address of the registered office and principal place of business (if different from the address of registered office)

- Information of the beneficial owner(s), for example:

- Identification document of the beneficial owner(s)

- Details of the ownership and control structure of the company

- Purpose and intended nature of the account, for example:

- Purpose of the account

- Expected account activities

- Business nature and mode of operation

- Information of the person acting on behalf of the customer, for example:

- Identification document of the person acting on behalf of the customer

- Authorisation document

Why So Many Documents?

These documents are required by the Hong Kong Monetary Authority, the bank regulator in HK, as before opening accounts for any individual or corporate clients, banks should undertake Customer Due Diligence (CDD) to fully understand their backgrounds. This also helps banks to provide appropriate services to their customers.

Unreasonable Request

Though there are CDD requirements, you should also beware of the possible abuse of banks’ power. Banks are prohibited to collect information that is disproportionate to the needs of risk assessment. These unreasonable requests include:

- requiring all directors and beneficial owners of an overseas corporate to be present at account opening;

- mandating that all documents of an overseas corporate are certified by a certifier in Hong Kong;

- requesting a start-up to provide the same degree of detail on its track record, business plan, and revenue projections as a long-established company;

- expecting a Hong Kong business registration certificate for all applicants or evidence of a Hong Kong office for all overseas corporates, irrespective of business model or mode of operation;

- requiring voluminous or very detailed information on the source of wealth sometimes going back decades irrespective of the risks presented by the relationship or type of service offered (e.g. MPF account, basic banking services with small balances) which is difficult or impossible for the customer to provide;

- rejecting account opening based on unreasonably high benchmarks such as expected or actual sales turnover;

- requiring a large amount of deposit; and/or

- making the purchase of insurance products or wealth management investment as the precondition of account opening.

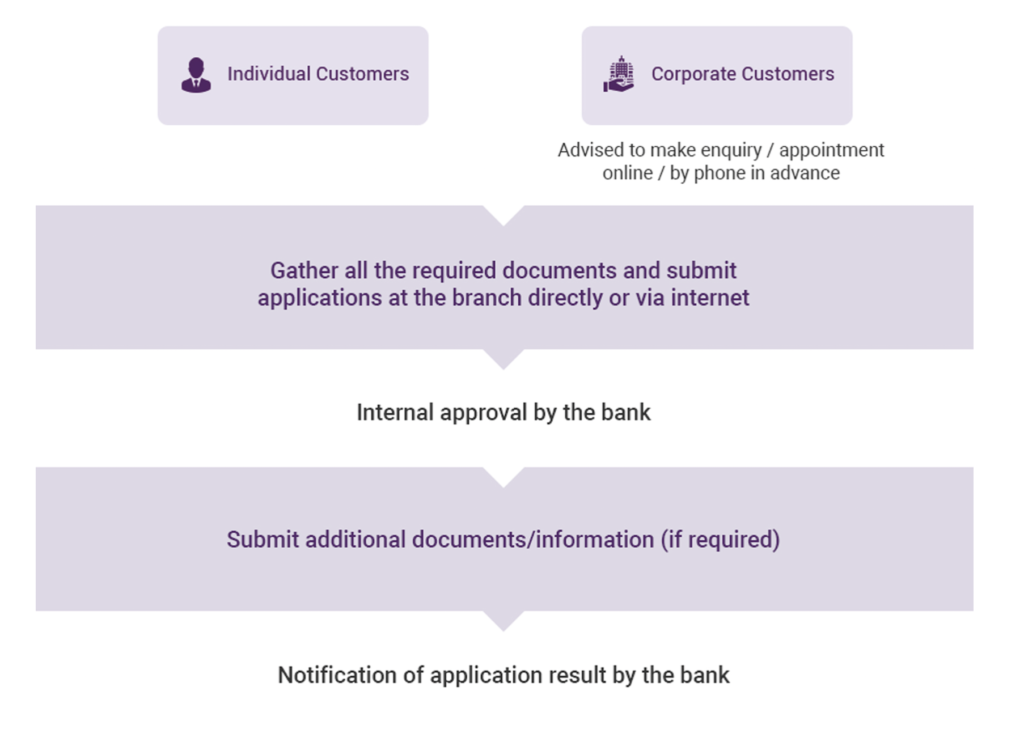

Submit Your Application

- Depending on your preference and the bank’s availability, submit an online application to upload all required documents or book an offline appointment to process.

- If you are visiting the bank in person, please make sure you’re taking the required documents and initial deposit, if any. Should there be any extra documents required, the bank will inform you.

- Normally, it should take around 2-4 weeks to complete the account opening process.

Account Opening – Successful!

💡 Congratulations on successfully opening your first bank account. With your business bank account, you can start dealing with your cash flows. Don’t forget to think about bookkeeping from Day 1 !

What To Do If The Application Fails

- We suggest that you contact the bank directly to ask for the reasons and appeal for a review.

- Normally, banks should provide a reasonable ground for any rejections, and there is a revision mechanism in place for unsuccessful applications.

- Should the requirements or any other processes appear unsuitable or you deem the application not able to move forward, you can consider going to another bank to open an account.

- You may want to consider letting the Hong Kong Monetary Authority (HKMA) know of any unfavorable rejection by sending an email to accountopening@hkma.gov.hk. However, note that this is unlikely to impact the status of your application immediately.

Appendix I: Introduction to Some Major Banks in Hong Kong

- HSBC – The Hong Kong and Shanghai Bank Corporation Limited(HSBC) is one of the largest bank in Hong Kong and is also one of the three note-issuing banks. As a global giant in banking, an account at HSBC would always be a good choice whether your business focus is local or global. HSBC offers three banking solutions for corporate users, namely the Sprint account, Business Direct account, and BusinessVantage account. Click the link to learn more.

- Standard Chartered – Standard Chartered, a Britain-headquartered multinational bank, is among the three note-issuing banks in Hong Kong. With numerous branches and ATMs in Hong Kong, It would also be a good choice to open an account at Standard Chartered if your business has a wide global reach.

- Citibank (Hong Kong) – Citi, the first foreign bank in Hong Kong, is also another leading bank, which provides comprehensive banking services for corporate users. Specially, Citi provides banking services targeting SMEs, which can be good choice if you have just kick started your business.

- Bank of China (Hong Kong) – Bank of China (Hong Kong) is one of the three note-issuing banks in Hong Kong, and the sole clearing bank for Renminbi (RMB) business in Hong Kong. It is a locally incorporated bank with close relations with its parent, Bank of China. If your business involves transactions in RMB in large volume, a BOCHK account is highly recommended.

- Bank of East Asia – Bank of East Asia (BEA), headquartered in Central, Hong Kong, is the largest independent local bank in Hong Kong. If your business targets local market, BEA would be a good choice for you.

- Hang Seng Bank – Hang Seng Bank is the second largest local bank in Hong Kong. If your business is primarily focusing on Hong Kong market, consider opening an account at Hang Seng Bank to enjoy the its comprehensive services and good discounts.

Additional Readings:

- Opening a Corporate Bank Account in Hong Kong by Hawksford: Opening a Corporate Bank Account in Hong Kong

- How to open a business bank account by Startupregistry: https://statrys.com/blog/opening-a-business-bank-account-in-hong-kong