Table of Contents

Table of Contents

A Checklist for Fund-Seeking Startup Founders

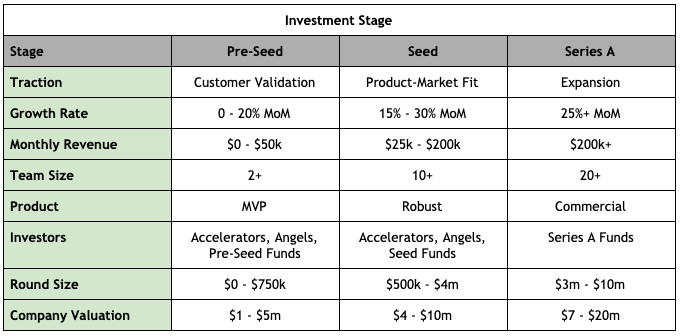

This guide is a checklist of deliverables that startup founders should prepare for to secure external funding to scale their businesses. Specifically, this guide targets startups in their earliest stages of development and financing: Pre-Seed, Seed, and Series A.

This founder’s checklist for early-stage fundraising is the second of our 3-part startup fundraising series. If you are not sure which stage of funding you are at, check out Part One using the link below!

Part One: Identify Your Startup’s Funding Stage

Guide to the Different Stages of a Startup

1) Pre-Seed Funding

Here is where you, the startup entrepreneur, raise the funds necessary to set up all initial priorities which are important to your business’s short-term objective of achieving a product-market fit (PMF). Pre-seed is not typically considered to be an official funding round, however, it is arguably one of the most important inflows of capital, especially for industries with high startup costs. Pre-seed funds are usually funneled towards MVP (Minimum Viable Product) development, market research, prototype testing & feedback, as well as licensing and IP.

Pre-Seed Funding Checklist:

- A scalable, competitive, and innovative idea

Scalable, competitive, and innovative businesses are very attractive to investors for their high-profit margins and long-term growth potential. Ask yourself the following questions:

a) Is your idea highly scalable, and possesses a sustainable competitive advantage?

b) Is it innovative and takes advantage of advanced technology?

c) Can it successfully address a market need, improve on existing concepts or solve a pain point in a particular industry?

d) So clearly defined to the point where you can explain it to someone effortlessly?

If your answer to all 4 questions is a resounding ‘Yes’, then it is likely that you have a great business idea on which the foundation of your startup is built. If you are most uncertain, this may be a sign for you to revisit your drawing board, critique every aspect of your idea and ask for feedback from as many people as possible.

- Establish a core founding team

It is important to assemble a core team of members who share a common goal in the company’s short-term and long-term successes. Once the team is established, create an organizational chart to effectively determine the control, reporting, and decision-making authority of each core member. Next, determine the founder(s)’ title, responsibility, and compensations, as well as the equity divisions of each core member. Finally, delegate preliminary roles to each member fitting their expertise, and in a way that is complimentary as a whole.

- The most important startup roles to immediately fill

- Steps to build a startup org chart

- Functionly’s org chart builder tool

- The ideal tech startup team structure

- Release & Optimize your Minimum Viable Product (MVP)

A Minimum Viable Product (MVP) is simply the first iteration and version of your final product containing only its very basic features. Your MVP is an essential pre-seed deliverable as it allows you to test your business idea using minimal cost and effort to gather responses from the target market, then pinpoint improvement areas for product development. After creating your MVP, release the product into the market as soon as possible so that you can test its usage with potential customers and obtain their feedback via interviews, questionnaires, etc. Finally, implement and adapt any necessary customer feedback into the next iteration of the product’s development cycle.

- Register your business

To protect the founder(s)’ personal assets, the company must be registered as a properly incorporated business entity as early as possible, while adhering to all state and local requirements. Startups are usually registered as an S corporation, C corporation, or LLC (Limited Liability Company). Wisely choose an appropriate business name, then secure the relevant website domain name and social media handles for future marketing and operational efforts. Last but not least, do not forget to print out business cards to professionally exchange contact information.

- Which type should you incorporate?

- Steps to registering your startup in Hong Kong

- Apply now to register your business in Hong Kong

- Early administrative setup

In your first administrative setup, open a company bank account and obtain an Employer Identification Number as early as possible in your startup journey. It is also very helpful to establish an efficient accounting & bookkeeping system early on to track business cash flow and finances, as well as for convenient tax-filling. Some of the best accounting software used by Hong Kong businesses are Sage, Xero, Osome, QuickBooks, SunSystems, and Express Accounts.

- Read our guide on Opening Bank Accounts in Hong Kong

- Protect your Intellectual Property (IP)

With the right type of intellectual property protection, you can prevent other people from stealing your designs, inventions, brand name, and more. There are 4 main types of IP: patents, copywriting, trademarks, and trade secrets.

- Create a website

Set up an excellent website, and relevant social media accounts and begin to build your brand presence. Your initial website should comprise an About Us page, contact information, site menu/ navigation bar, core services & pricing, online ordering, customer testimonials, and the company blog. As part of your marketing efforts, we recommend you enhance your website traffic through paid advertising with Google Analytics and Google Ads, search engine optimization (SEO) with Google Search Console, as well as social media such as Facebook and Instagram.

See below the list of guides that may be helpful for you:

- How to create a website with Wix

- Guide to Using Google Analytics Report for Your Business

- How to set up Google Ads and Conversion Tracking

- Guide to Google Ads for Leads

- Guide to Google Ads for Ecommerce

- Guide to SEO using Google Search Console

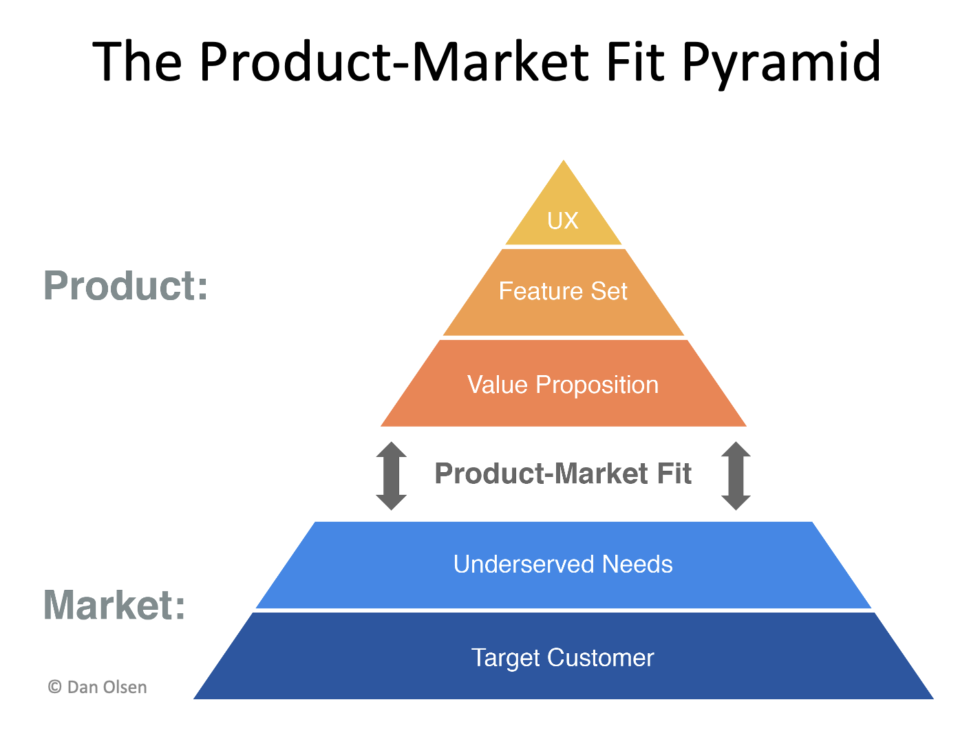

- Define your Product-Market Fit (PMF)

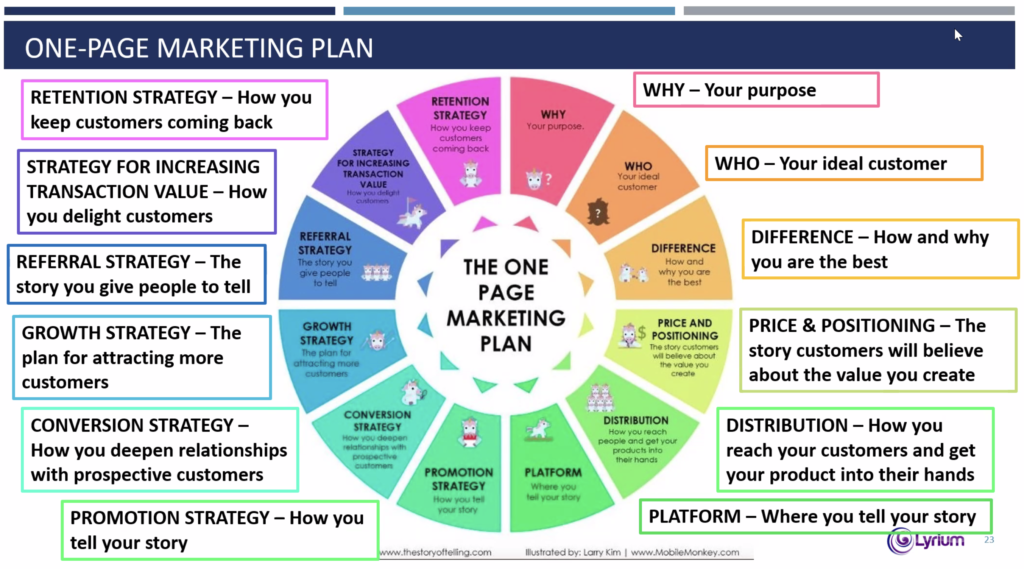

The Product-Market Fit (PMF) is the gold standard every startup strives to achieve and is identified by many as key to a business’ long-standing success. To put it simply, PMF is an ideal scenario where a product satisfies and is in high demand by its target market. The key is to identify your target customer profile and deliver underserved customer needs. At PMF, the company’s target customers are buying, using, and telling others about the product in numbers large enough to sustain that product’s growth and profitability.

This step also involves planning a revenue model & marketing strategy through which you aim to deliver maximum value. As the business develops, it is important to remain agile and flexible enough to deviate from the original plan if necessary. Writing a long business plan is not a priority for startups. Instead, focus on creating your MVP, conducting market research, developing a great investor pitch, and preparing detailed financial projections.

- Don’t waste time on a startup business plan. Do these 5 things instead.

- Develop your investor pitch

Before asking for a single dime, you should first do a thorough calculation of the startup’s potential burn rate to estimate the amount of funding you will ask for. Consider one-time, labor, and overhead costs such as office rent, utilities, etc. Last but not least, the entrepreneur should always have an elevator pitch prepared & be ready to proficiently deliver it at any moment’s notice.

- Guide to pitching your business

- Calculate your startup costs

- Questions by angel investors to prepare for

- Tips for effective public speaking

2) Seed Funding

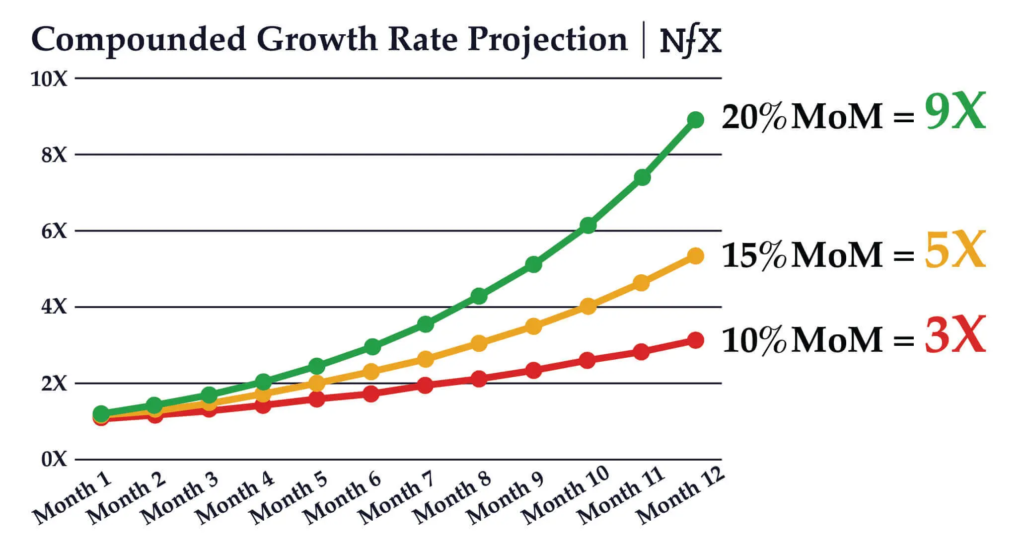

After laying the initial groundwork for your startup, it is time to really get your idea off the ground in the developmental seed stage. The seed (financial support) is planted and fostered to grow into an adult plant using sufficient water, sunlight, and oxygen (revenue, shrewd persistence, and strategic business planning). Seed capital is intended to grow a fully validated business idea into a revenue-generating entity and tends to be funneled towards enhancing the PMF and pushing your MVP into the competitive marketplace, in addition to more market R&D.

Seed Funding Checklist:

- Promising & passionate founders

Generally, investors are attracted to passionate founders with financial skin in the game, meaning that he or she has successfully raised initial capital by investing through personal funds or bootstrapping. There is no scorecard that can accurately detect ‘promising’ entrepreneurs, but founders with a high probability of success tend to possess strong execution skills, well-built plans with specific targets, and most of all, a harmonious organizational structure. One of the main roles of a founder is to understand and make decisions based on the realities of customer needs, market trends, and financial constraints. And since startups are fast-growing, it is important for entrepreneurs to learn how to expertly balance the line between too much planning and too little.

- 2nd administrative set-up

The second operation and administrative set-up are to purchase an appropriate business insurance coverage plan as a risk transfer, as well as establish industry-specific permits such as business licenses & location.

- Generate a Capitalization Table

A capitalization table, or cap table, provides investors with a concrete picture of company ownership. The table comprises information such as the percentage equity of the company owned by the founders, employees, and investors, thereby giving insight to the company’s decision-making structure.

- Generate a cap table using this template (also contains Series A Cap Table template)

- Improve your investor pitch

At this stage, you should continue to focus on optimizing your minimum viable product and refining your product-market fit. To prepare for Seed stage funding, you will need to develop an increasingly comprehensive, indefensible & updated investor pitch and business strategy. Investors need proof of a significant market size and competitive advantage. Furthermore, it is also time for you to prepare and develop a clear exit strategy, which is a plan that tells investors and equity holders how and when they can receive a potential return on their investments. It is essential to substantiate your strategy via thorough financial projections, such as ROI (Return On Investment) analysis and 2/3/5-year proforma financials (income statement, balance sheet, cash flow statement).

- Guide to pitching your business

- Guide to the different types of startup exit strategies

- Steps to planning your exit strategy

- ROI analysis

3) Series A Funding

After the seed stage comes Series A, often referred to as the make-or-break stage. This is because successfully surmounting the stage gap between the seed and series A is one of the most challenging parts of establishing a startup venture. During this funding stage, startups are expected to hit all of their near-term milestones whilst retaining their focus on long-term revenue growth and profitability. Series A funds are used to address capital needs such as hiring, marketing, and operations. These funds are also funneled towards scaling the production of a commercially viable product and building a substantial target consumer base to prove that the company is angled in a favorable position toward sustained growth.

Series A Funding Checklist:

- Find a suitable VC

There are many different venture capital firms, and each of them tends to target a specific industry sector, company stage, or geographical location. Thus, it is necessary to research and understand which VC to approach by understanding the criteria of their investment focus. Many founders actively create connections to VCs, such as through professional networking, startup networking groups, accelerators, and mentoring programs.

- Complete due diligence of all important documents

Before seeking Series A investments, complete an up-to-date and in-order due diligence of corporate records, general business, legal matters, financial documents, contract details, IP, assets, and employee information.

- Demonstrate traction and long-term profitability using financial evidence

VCs tend to favor profitability and sustainability over growth when it comes to analyzing a company’s success potential. Can you successfully demonstrate that your business strategy is not only viable, highly scalable, and fast-growing but is also positioned toward long-term profitability? Can you prove that your business has latent demand, sufficient traction, and, promising unit economics? To show that you are a promising candidate for Series A investment, words are not enough. You will also need to provide evidence of financial progress through quantitative and quantitative growth metrics. This is to prove that you are generating a steady stream of revenue and growing an established customer base.

- Demonstrate PMF, Product Differentiation (PD), and Value Proposition (VP)

Have you achieved a product-market fit (PMF)? Does your business successfully demonstrate product differentiation (PD)? What is your value proposition (VP)? When you find that your business meets all 3 criteria, you will see tangible results through strong retention rates (low customer churn), increased pricing power, as well as increased upselling/ cross-selling opportunities. Read more below to understand each criterion:

a) PMF is achieved when a product concept is validated in the target market through consistent organic consumption and word-of-mouth promotion.

b) PD is a differentiating factor, or economic ‘moat’, which can contribute towards a sustainable and long-term competitive advantage.

PD is a way that companies can ‘protect’ profit margins and their share of the market. When a product is commoditized, like sugar, computers, and cloud storage, competitors tend to offer similar value and thus, minimal product differentiation. This results in low growth opportunities because competition will be based on pricing rather than product value. As a result, startups have to embrace innovation and achieve differentiation on their products to escape the commodity trap. Even successful brands, such as Apple and Microsoft, are continuously reinventing their PD to remain competitive.

C) VP is the extent to which a product is valuable and needed by customers.

A product’s VP can be measured by the duration of existing customer relationships and past customer attrition rates. Customer attrition represents the number of customers lost by a company, and this is inevitable. A healthy customer attrition rate may indicate that the product is offering sufficient value to its customers. On the other hand, excessive attrition rates should be addressed, since the cost of retaining a customer is far less than acquiring a new one and this highlights a critical weakness in the company’s product and services.

- Expand your team

At this stage, you can consider expanding your team by hiring more personnel to support your growing operations. Begin researching for professional help, such as experienced lawyers and accountants, to outsource some key roles. In the early stages of a startup, hiring freelancers or consultants as specialized experts is often prudent to minimize expenses. Last but not least, manage labor legislations, employee benefits & insurance compensation coverage for your employees.

Read below some helpful guides:

- Guide to Hiring Your First Employee in Hong Kong

- Labour legislation and employers’ obligation in Hong Kong

- How to enroll your employees in MPF (Mandatory Provident Fund) schemes in Hong Kong

Are You Prepared to Begin Your Startup Fundraising Journey?

This founder’s checklist for early-stage fundraising is only the second of our 3-part startup fundraising series. For more information on startup funding options in Hong Kong, go to Part 3 with the link below!

Part Three: Your Guide to Applying for Startup Funding in Hong Kong